nh meals tax change

Concord NH Today Governor Chris Sununu issued the following statement as the reduction in the Meals and Rooms Tax from 9 to 85 takes effect today. Years ending on or after December 31 2026 NH.

Pin By Cindy Brown On Fish In 2022

This budget helps small businesses by reducing the Business.

. If you have questions call 603 230. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. NH Meals and Rooms tax decreasing by 05 starting Friday.

New Hampshires governor signed into law a two-year 135 billion budget package Friday that cuts the states business tax rates phases out the interest and dividends tax and cuts the. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at 603 230-5920.

Nh meals tax change. Chapter 144 laws of 2009 increased the rate from 8 to the current rate of 9 and added. Years ending on or after December 31 2026.

Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the. Bill supporters say it will level the. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates.

New Hampshire Meals and Rooms Tax is decreasing from 9 to 85 effective October 1 2021. The budget cuts the 5 interest and dividends tax by one percent a year. Starting October 1 2021 the New Hampshire Department of Revenue.

By law cities towns and unincorporated places in New Hampshire are supposed to get 40 of the meals and rooms tax revenue but that became less certain after the 2009 recession. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

Chris Sununu in this years budget package which passed. Concord NH Today Governor Chris Sununu issued the following statement after the New Hampshire Senate announced that New Hampshire municipalities are receiving a 45. New hampshire is one of the few states with no statewide sales tax.

New Hampshire cuts tax on rooms meals to 85. New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021. This budget helps consumers by reducing the Meals and Rooms Tax from 9 to 85 its lowest level in over a decade.

Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85. 0 zero NHs Meals and Rooms Tax currently imposes a 9 tax on the. Years ending on or after December 31 2025 NH ID rate is 3.

Concord NH The. Speaking of the rooms and meals tax the budget would cut that rate from 9 85 starting in January. AP Dining and staying overnight in New Hampshire just got a little bit less expensive.

AP Dining and staying overnight in New Hampshire just got a little bit less expensive. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. Years ending on or after December 31 2024 NH ID rate is 4.

Starting Friday the states tax on rooms and meals was reduced from. Years ending on or after December 31 2027. MEALS RENTALS TAX RETURN Instructions Meals Rental Operators may file electronically on the Departments website at wwwrevenuenhgovgtc.

The state meals and rooms tax is dropping from 9 to 85. 1 those in New Hampshire eating at restaurants and food service establishments purchasing. The House approved a bill that extends the rooms and meals tax to online platforms that coordinate private auto and short term rentals.

Advertisement Its a change that was proposed by Gov.

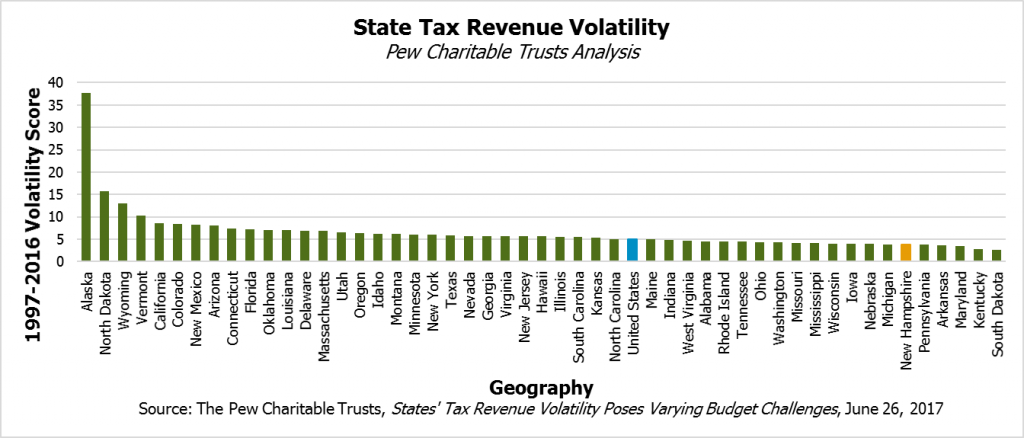

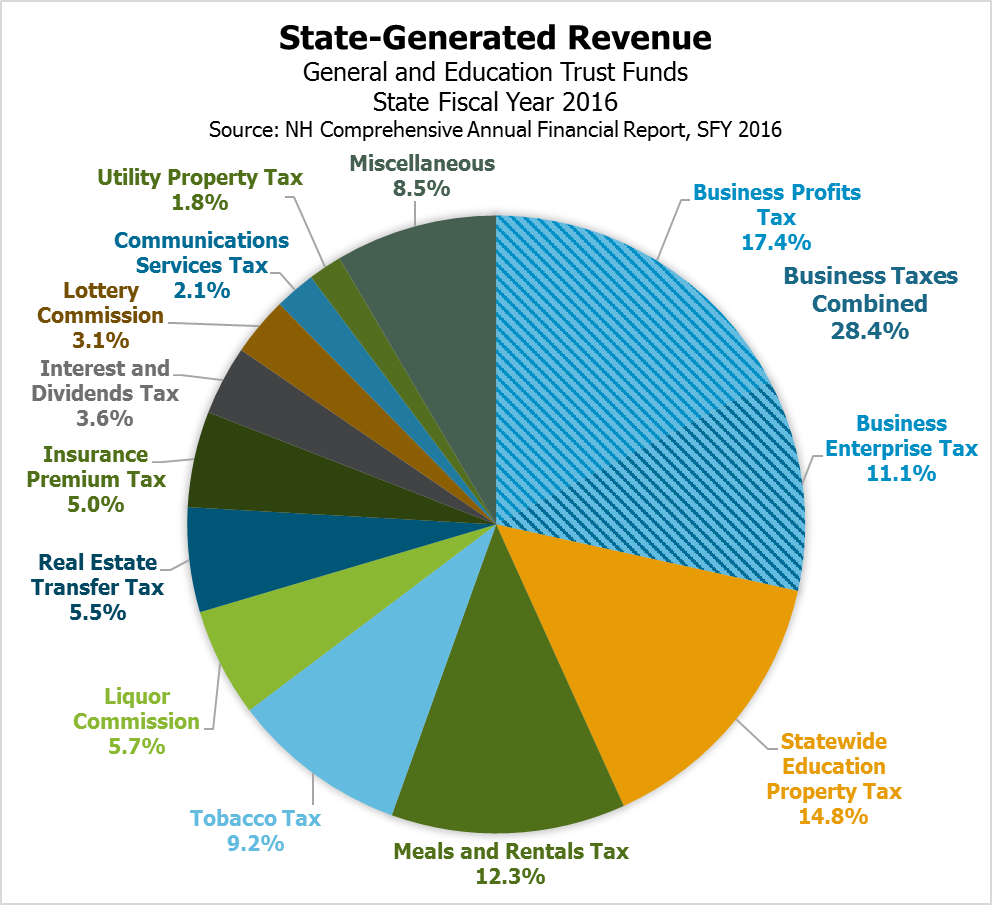

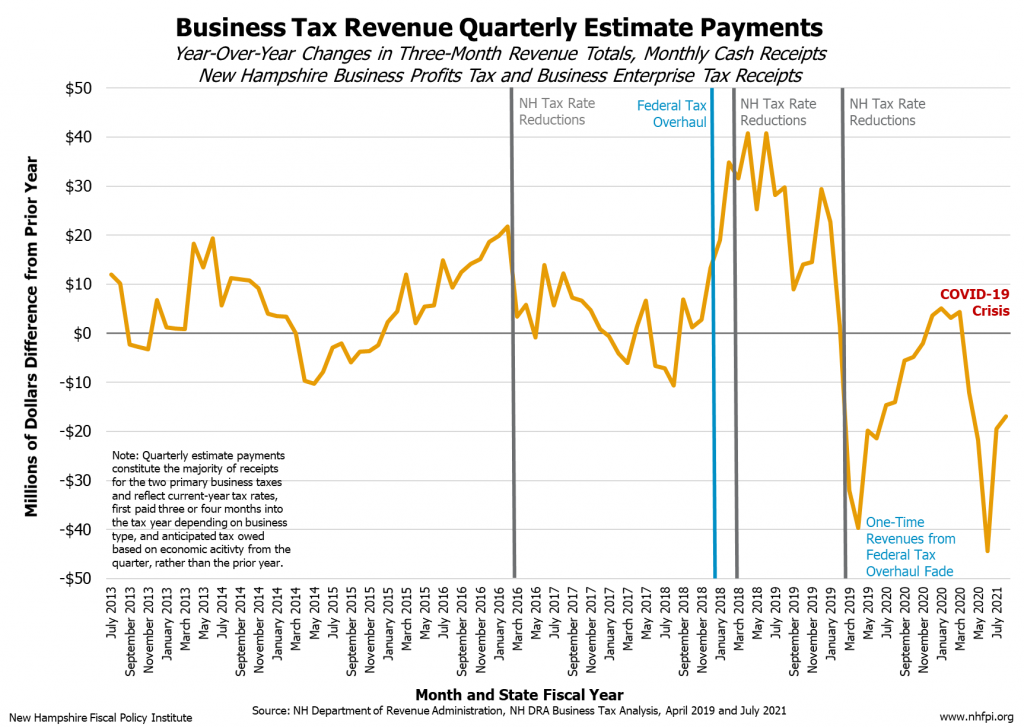

State S Diverse Tax Base Stabilizes Revenue But Business Tax Changes May Increase Volatility New Hampshire Fiscal Policy Institute

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Sales Taxes In The United States Wikiwand

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Stabilization Grants And New Tax Changes For 2021 Webinar Recording Tom Copeland S Taking Care Of Business

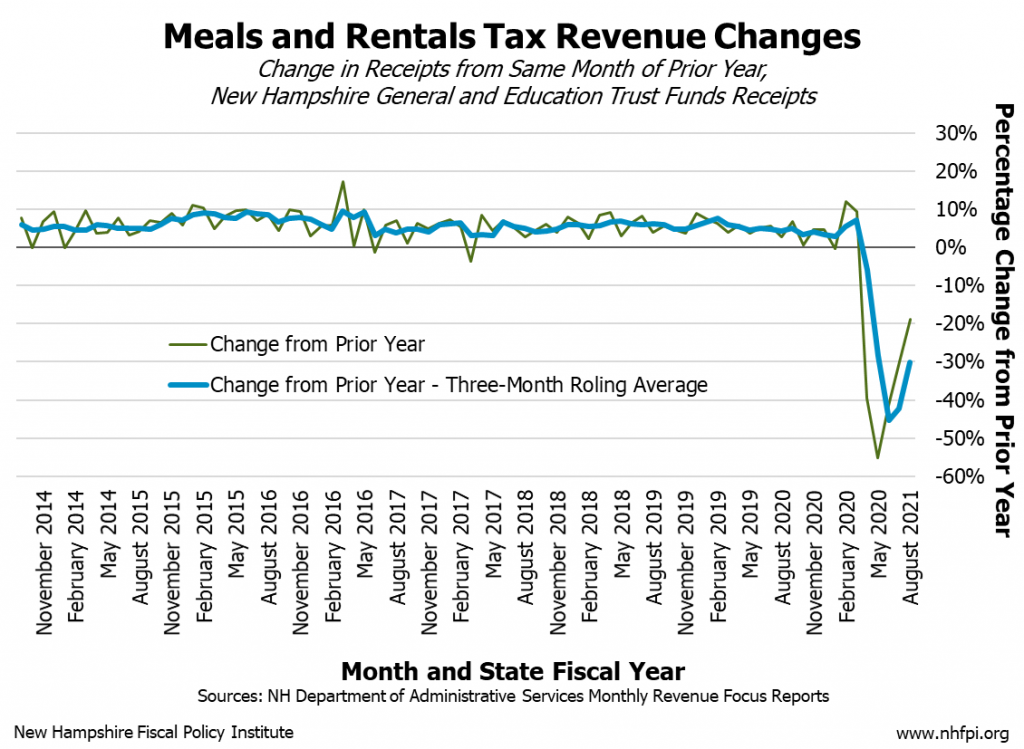

Early Impacts Of The Covid 19 Crisis On State Revenues New Hampshire Fiscal Policy Institute

New Hampshire House Oks Budget Fueled By Tax Cuts Nh Business Review

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

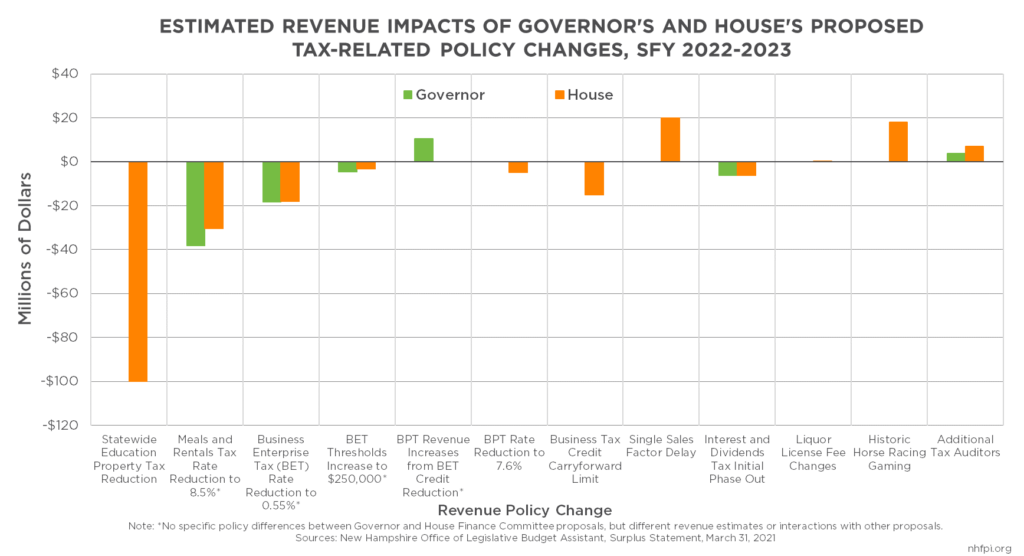

The House Of Representatives Budget Proposal For State Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

New Hampshire Meals And Rooms Tax Rate Cut Begins

Maine S Biggest Tax Changes This Year And What They Mean To You

State S Diverse Tax Base Stabilizes Revenue But Business Tax Changes May Increase Volatility New Hampshire Fiscal Policy Institute

If Your Life Changed In 2021 Watch For Income Tax Surprises Wbur News

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Thanksgiving Buffet At Woodlake Country Club On November 28th Celebrate Thanksgiving With Family And Frien Champagne Vinaigrette Fruit Display Antipasto Salad

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Tax Season 2022 H R Block Newsroom

Donor Towns Tax Cuts And The Elusive Education Funding Solution New Hampshire Bulletin

Early Impacts Of The Covid 19 Crisis On State Revenues New Hampshire Fiscal Policy Institute